Key Takeaways

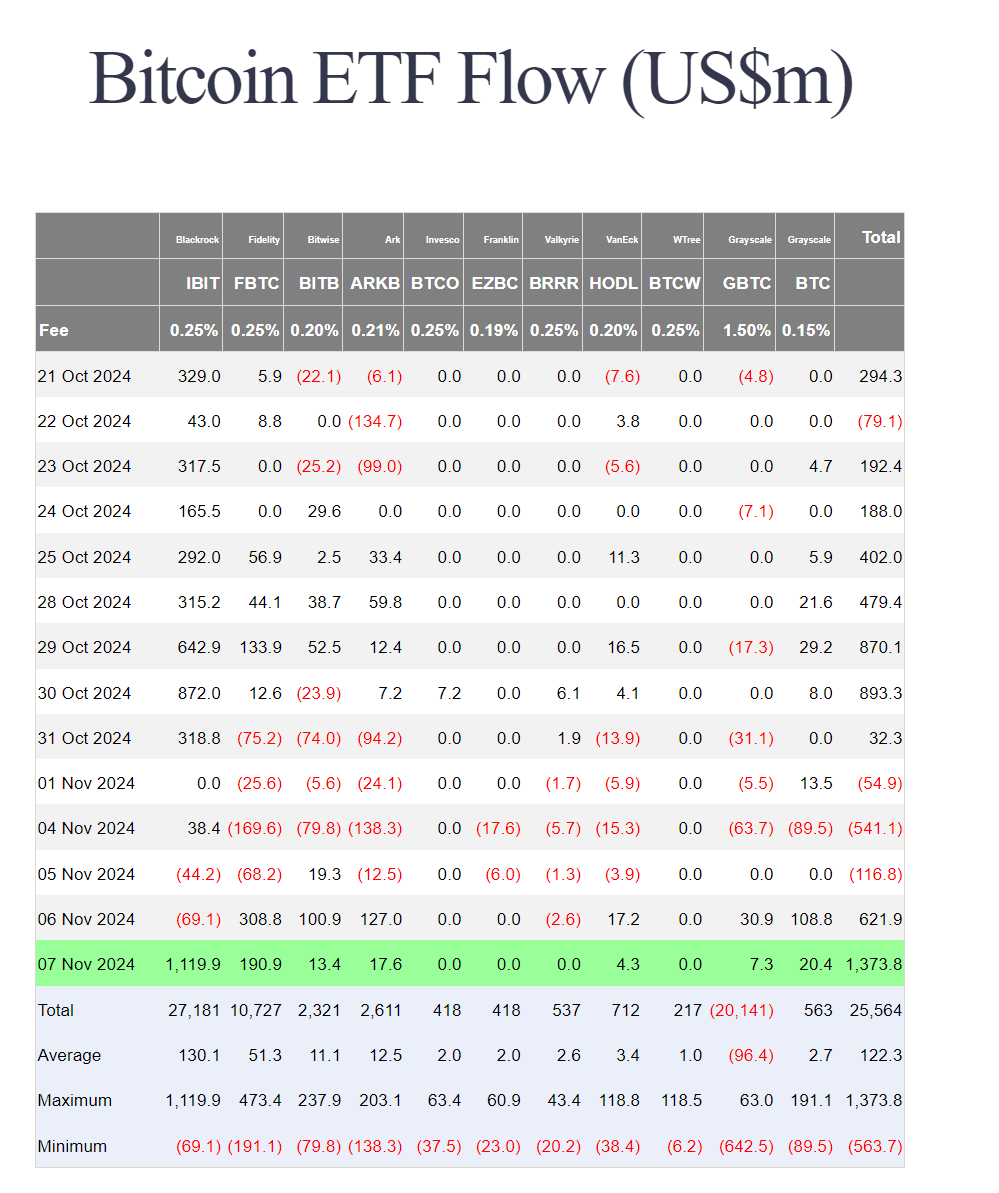

- BlackRock’s Bitcoin ETF saw a record single-day inflow of $1.1 billion.

- Total inflows for US spot Bitcoin ETFs reached $1.37 billion during the session.

Share this article

BlackRock’s iShares Bitcoin Trust (IBIT) recorded $1.1 billion in inflows during a single trading session, marking the largest one-day inflow among US spot Bitcoin ETFs. The total inflows across all Bitcoin ETFs reached $1.37 billion during the session.

BlackRock’s ETF dominated the day’s activity with $1.12 billion in inflows, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) attracted $190.9 million during the same period.

The substantial ETF inflows coincided with Bitcoin’s price movement, which briefly reached $76,500 before settling around $75,700. The reported flows may reflect activity from the previous trading day due to T+1 reporting, explaining why BlackRock’s ETF showed negative flows in the prior session while other funds saw major inflows.

Since their launch in January 2024, US spot Bitcoin ETFs have accumulated billions in assets under management, with BlackRock’s IBIT emerging as the market leader.

Last month, US spot Bitcoin ETFs reached a record asset value over $66.1 billion, thanks to a six-day inflow streak and a Bitcoin price increase.

Share this article

Source link

#Blackrocks #Bitcoin #ETF #draws #record #billion #singleday #inflow

top altcoins, Ethereum alternatives, new cryptocurrencies

crypto trading bots, automated trading strategies, AI in cryptocurrency

Bitcoin mining, Ethereum mining, best crypto mining hardware

Bitcoin news, cryptocurrency latest news, blockchain updates

best crypto wallets, secure Bitcoin wallets, multi-currency wallets reviews

blockchain technology, fintech innovations, decentralized finance (DeFi)

crypto market analysis, Bitcoin price prediction, Ethereum forecast

cryptocurrency predictions, Bitcoin price forecast, crypto trends 2024, crypto trends 2025

live Bitcoin prices, crypto price updates, Ethereum price report

how to trade cryptocurrency, crypto trading strategies, beginner crypto trading

Welcome to “Cryptocurrency Trading,” your comprehensive destination for the latest news and analysis in the world of **cryptocurrencies** and **currency trading**. We provide rich content focused on **market analysis**, **trading strategies**, and **emerging technologies** that impact the **cryptocurrency market**. Join us to discover the **best investment opportunities** in **Bitcoin**, **Ethereum**, and other leading cryptocurrencies. Our goal is to equip you with the information you need to enhance your trading skills and achieve success in the world of **investment**. Follow us for continuously updated content that supports you in making informed decisions.