Key Takeaways

- BlackRock attracted $3 billion in digital asset product inflows in the first quarter of 2025.

- Digital assets represent a small portion of BlackRock’s business, accounting for 0.5% of total assets under management.

Share this article

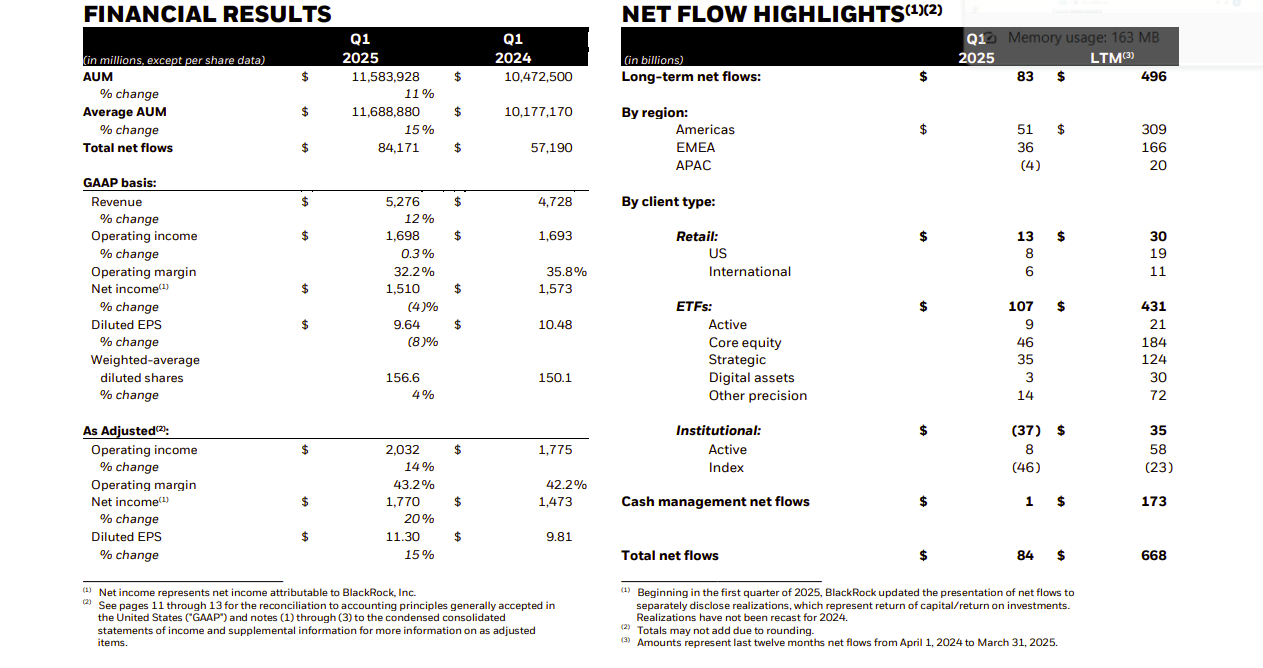

Investors poured around $3 billion into BlackRock’s digital asset products in Q1 2025, contributing to $84 billion in total net inflows for the quarter, according to the firm’s first-quarter earnings release on April 11.

BlackRock’s iShares ETF platform brought in a strong $107 billion in net inflows during Q1 2025. However, the firm’s total net inflows came in lower at $84 billion, as outflows in other segments—notably a $45.5 billion pullback from institutional index funds—offset the ETF gains.

BlackRock’s digital assets under management stood at over $50 billion at the end of Q1, up from $17.5 billion a year ago, which represents a 187% increase year-over-year. This surge dwarfed the growth rate of other asset classes within the firm’s portfolio, such as equities, which was up 8% YoY to $5.7 trillion.

The first quarter also brought notable volatility. Even though digital assets attracted over $3 billion in net inflows, market depreciation reduced their value by over $8 billion.

As of March 31, the global asset manager oversees approximately $11.6 trillion worth of client assets.

Digital assets make up just 1% of BlackRock’s total AUM, with their $3 billion net inflows accounting for 2.8% of total ETF inflows in Q1 2025. For comparison, private market investments brought in $9.3 billion during the same period.

Digital asset-related investment advisory and admin fees reached $34 million in Q1, less than 1% of BlackRock’s total $4.1 billion in long-term revenue as of March 31.

That figure aligns with the segment’s AUM share but underscores the low-fee structure typical of digital offerings.

For example, the iShares Bitcoin Trust (IBIT), BlackRock’s flagship crypto ETF launched in early 2024, operates at a competitive 0.25% fee post-waiver.

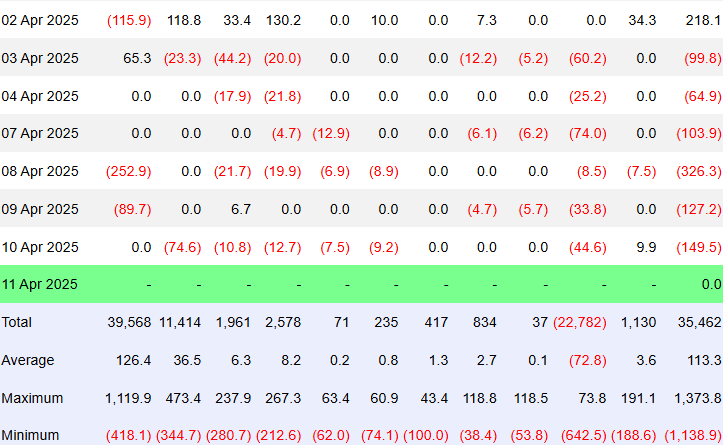

The report comes as US-listed spot Bitcoin ETFs saw their sixth straight day of net outflows, with $149 million in redemptions yesterday, according to Farside Investors.

The withdrawals were led by Fidelity’s FBTC and Grayscale’s GBTC, amidst a broader market movement where investors sought safer assets such as gold and cash, influenced by escalating US-China tariff disputes and market volatility tied to US policy changes.

Share this article

Source link

#BlackRock #draws #billion #digital #asset #inflows #AUM #reaches #trillion

top altcoins, Ethereum alternatives, new cryptocurrencies

crypto trading bots, automated trading strategies, AI in cryptocurrency

Bitcoin mining, Ethereum mining, best crypto mining hardware

Bitcoin news, cryptocurrency latest news, blockchain updates

best crypto wallets, secure Bitcoin wallets, multi-currency wallets reviews

blockchain technology, fintech innovations, decentralized finance (DeFi)

crypto market analysis, Bitcoin price prediction, Ethereum forecast

cryptocurrency predictions, Bitcoin price forecast, crypto trends 2024, crypto trends 2025

live Bitcoin prices, crypto price updates, Ethereum price report

how to trade cryptocurrency, crypto trading strategies, beginner crypto trading

Welcome to “Cryptocurrency Trading,” your comprehensive destination for the latest news and analysis in the world of **cryptocurrencies** and **currency trading**. We provide rich content focused on **market analysis**, **trading strategies**, and **emerging technologies** that impact the **cryptocurrency market**. Join us to discover the **best investment opportunities** in **Bitcoin**, **Ethereum**, and other leading cryptocurrencies. Our goal is to equip you with the information you need to enhance your trading skills and achieve success in the world of **investment**. Follow us for continuously updated content that supports you in making informed decisions.