Key Takeaways

- US Bitcoin ETFs saw massive outflows of $435 million as Bitcoin’s price fell below $93,000.

- MicroStrategy made its largest Bitcoin purchase ever, acquiring 55,500 BTC worth $5.4 billion.

Share this article

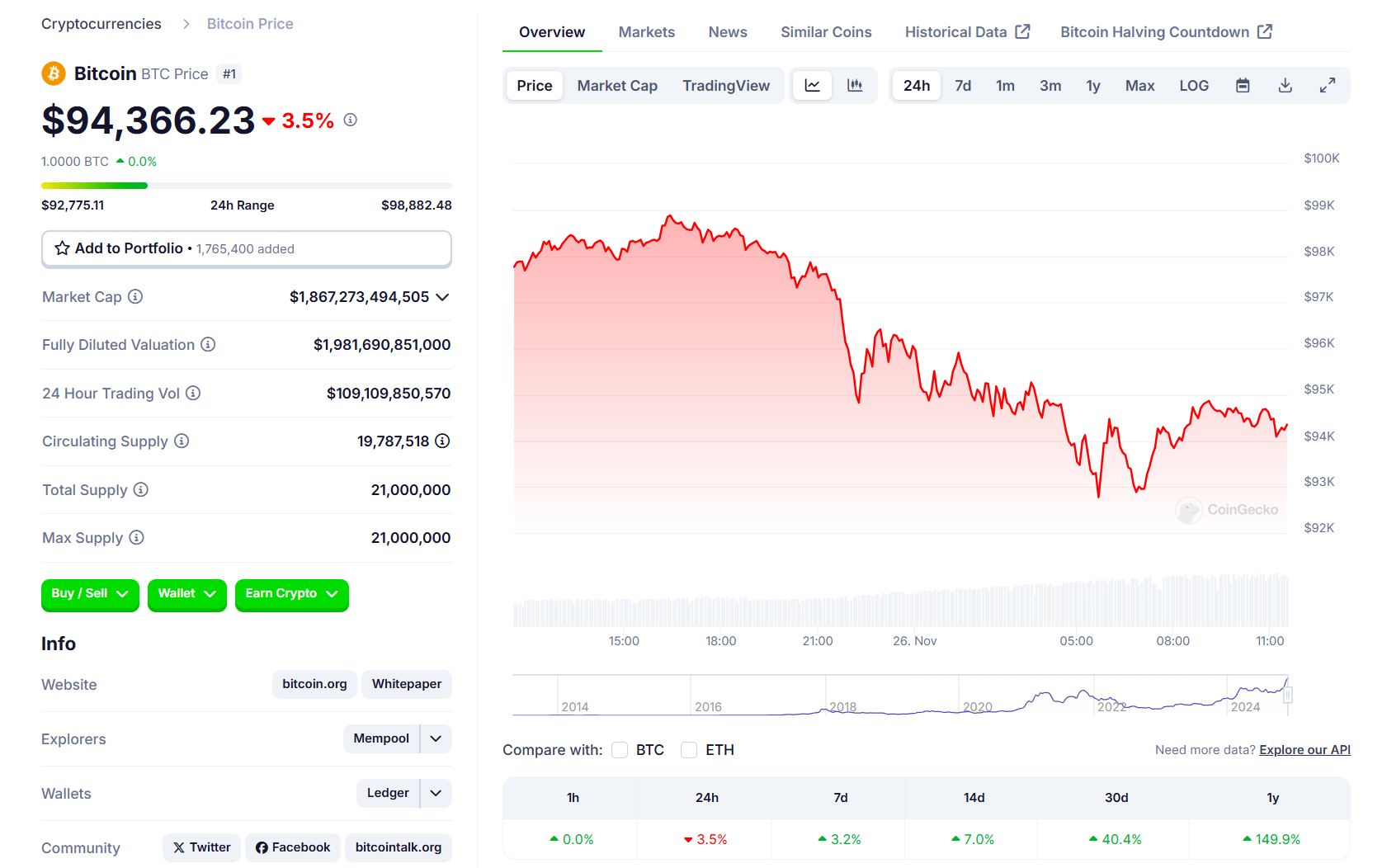

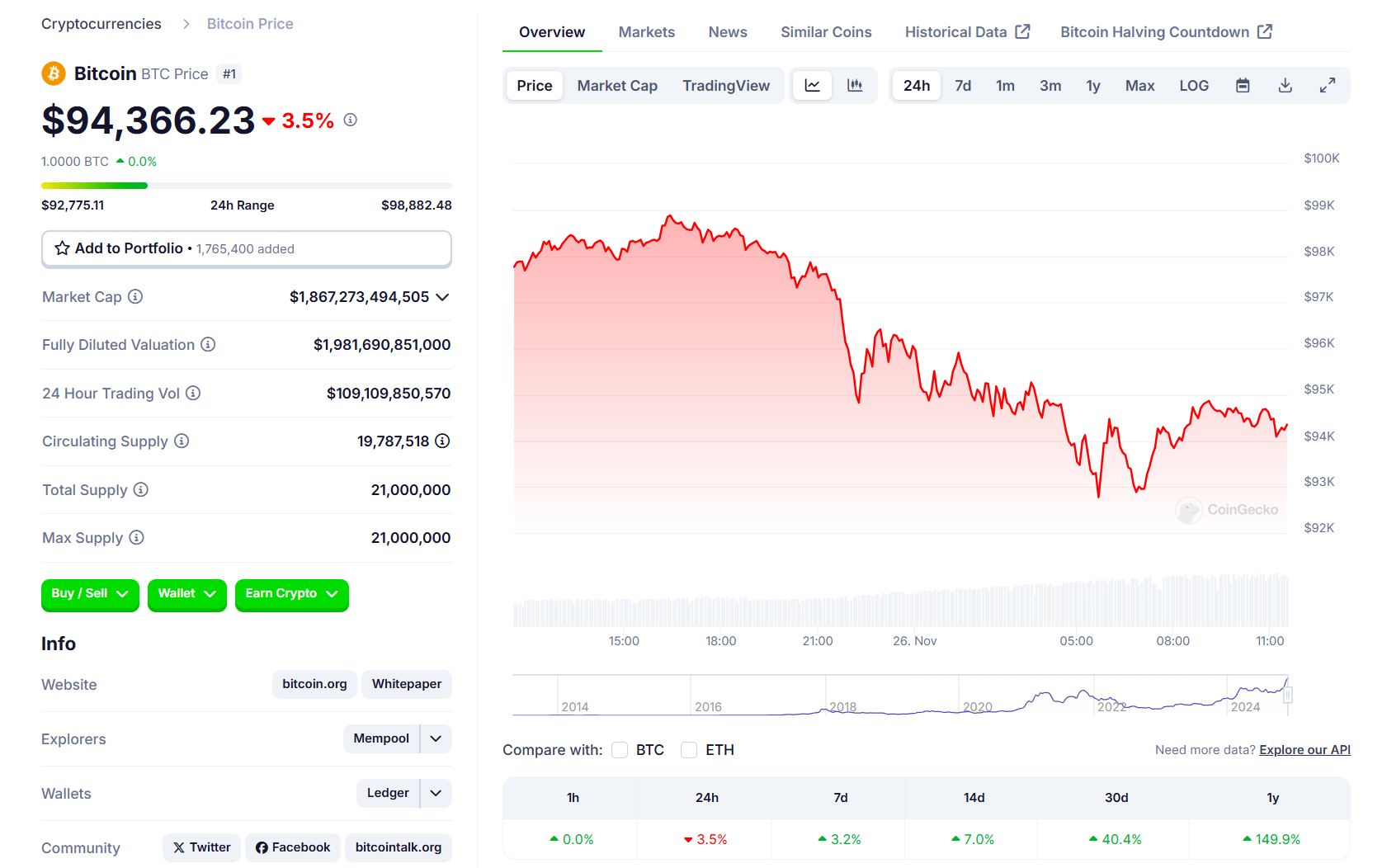

US Bitcoin ETFs faced massive outflows on Monday amid Bitcoin’s retreat below $93,000.

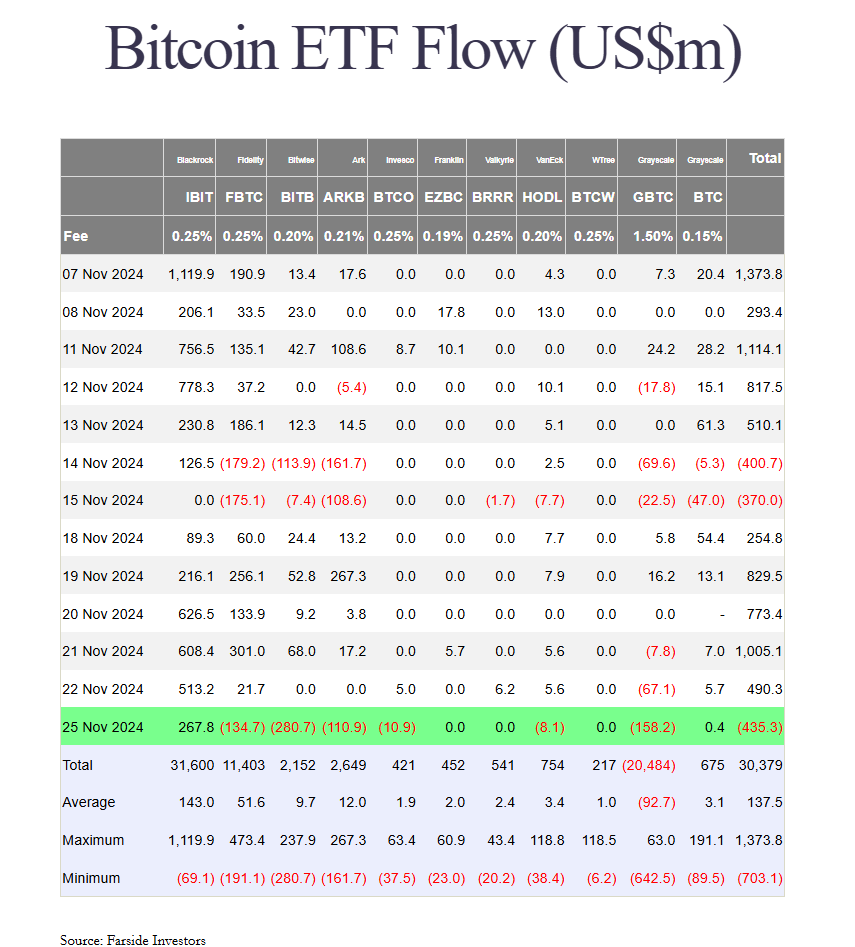

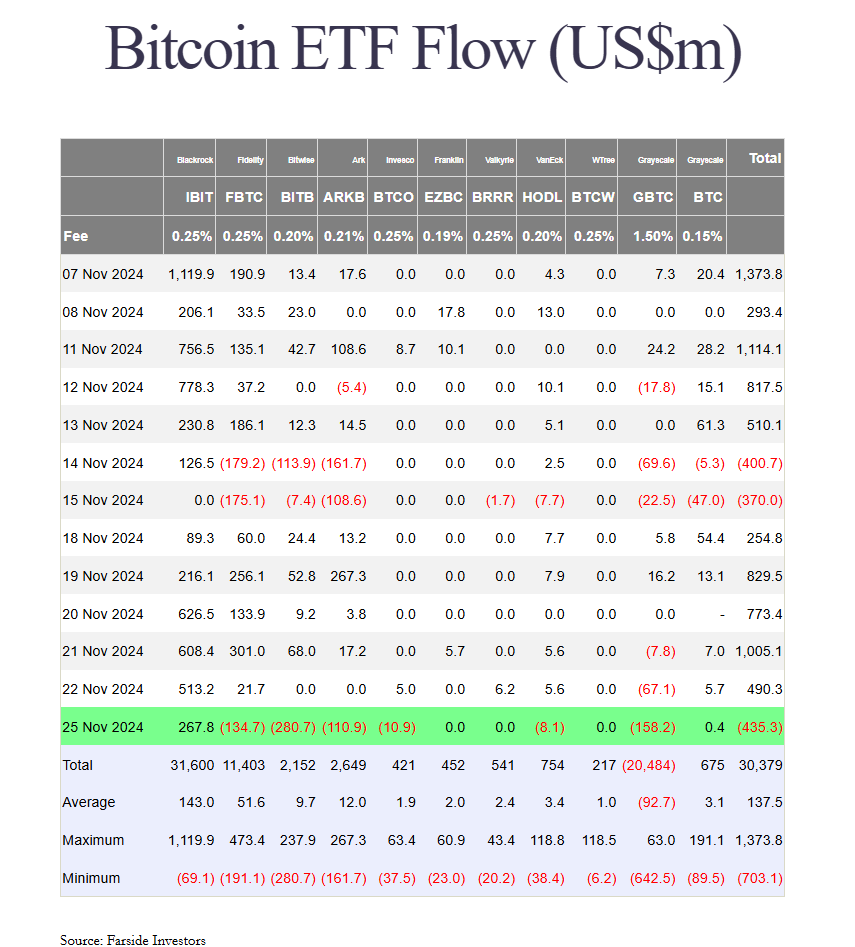

The eleven spot Bitcoin ETFs collectively saw net outflows totaling $435 million, with only BlackRock’s iShares Bitcoin Trust (IBIT) and Grayscale’s Bitcoin Mini Trust (BTC) attracting inflows.

According to data from Farside Investors, IBIT captured approximately $268 million in net inflows, while BTC took in $400,000.

Bitwise’s Bitcoin ETF (BITB) and Grayscale’s Bitcoin Trust (GBTC) faced substantial investor withdrawals. BITB recorded its largest-ever outflow of $280 million, while GBTC saw its most significant daily redemption in three months, amounting to $158 million.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) and ARK Invest’s Bitcoin ETF (ARKB) saw outflows of $135 million and $111 million, respectively. Invesco and Valkyrie’s funds collectively lost $19 million.

The intense outflows marked a sharp reversal from last week’s performance when US Bitcoin ETFs attracted $3.3 billion, with BlackRock’s iShares Bitcoin Trust (IBIT) securing over 60% of total inflows.

The setback came as the broader crypto market turned bearish.

Bitcoin’s recent push for $100,000 was thwarted as it fell under $93,000, according to data from CoinGecko. The flagship crypto is now trading at around $94,300, down 3.5% in the last 24 hours.

The decline came amid increased selling pressure from long-term holders, who have sold over 461,000 BTC since the asset’s recent peak above $99,000, Crypto Briefing reported.

Despite the bearish trend, there’s speculation about a potential rebound if the price stabilizes and reaccelerating investor demand. On Monday, MicroStrategy announced it had acquired another 55,500 BTC worth $5.4 billion. It’s the company’s largest Bitcoin acquisition to date.

Market participants are monitoring macroeconomic factors, including inflation data and Federal Reserve statements, which could influence near-term price action.

Share this article

Source link

#Bitcoin #ETFs #fiveday #inflow #streak #Bitcoin #dips #93K

top altcoins, Ethereum alternatives, new cryptocurrencies

crypto trading bots, automated trading strategies, AI in cryptocurrency

Bitcoin mining, Ethereum mining, best crypto mining hardware

Bitcoin news, cryptocurrency latest news, blockchain updates

best crypto wallets, secure Bitcoin wallets, multi-currency wallets reviews

blockchain technology, fintech innovations, decentralized finance (DeFi)

crypto market analysis, Bitcoin price prediction, Ethereum forecast

cryptocurrency predictions, Bitcoin price forecast, crypto trends 2024, crypto trends 2025

live Bitcoin prices, crypto price updates, Ethereum price report

how to trade cryptocurrency, crypto trading strategies, beginner crypto trading

Welcome to “Cryptocurrency Trading,” your comprehensive destination for the latest news and analysis in the world of **cryptocurrencies** and **currency trading**. We provide rich content focused on **market analysis**, **trading strategies**, and **emerging technologies** that impact the **cryptocurrency market**. Join us to discover the **best investment opportunities** in **Bitcoin**, **Ethereum**, and other leading cryptocurrencies. Our goal is to equip you with the information you need to enhance your trading skills and achieve success in the world of **investment**. Follow us for continuously updated content that supports you in making informed decisions.